1.3. Use Case: Process-based solutions in the loan industry

This section describes a use case of deploying JBoss BPM Suite to automate business processes (such as loan approval process) at a retail bank. This use case is a typical process-based specific deployment that might be the first step in a wider adoption of JBoss BPM Suite throughout an enterprise. It leverages features of both business rules and processes of JBoss BPM Suite.

A retail bank offers several types of loan products each with varying terms and eligibility requirements. Customers requiring a loan must file a loan application with the bank. The bank then processes the application in several steps, such as verifying eligibility, determining terms, checking for fraudulent activity, and determining the most appropriate loan product. Once approved, the bank creates and funds a loan account for the applicant, who can then access funds. The bank must be sure to comply with all relevant banking regulations at each step of the process, and has to manage its loan portfolio to maximize profitability. Policies are in place to aid in decision making at each step, and those policies are actively managed to optimize outcomes for the bank.

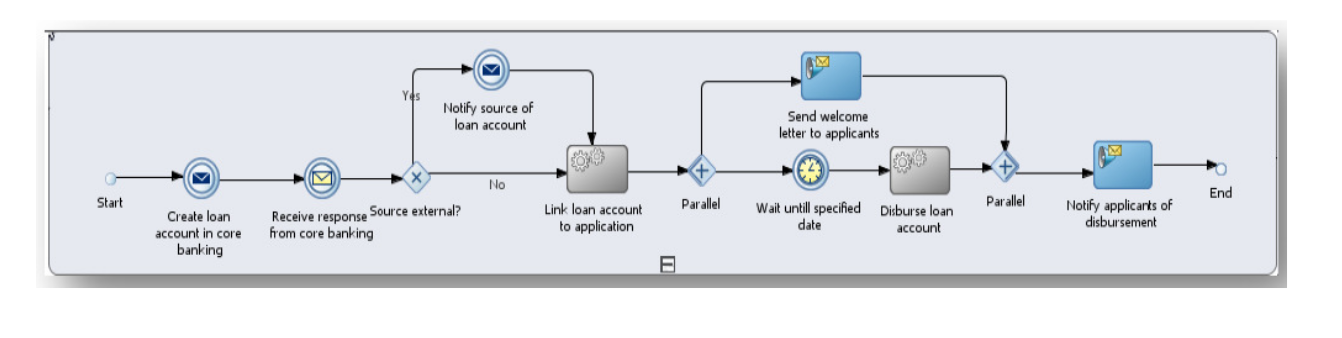

Business analysts at the bank model the loan application processes using the BPMN2 authoring tools (Process Designer) in JBoss BPM Suite. Here is the process flow:

Figure 1.1. High-level loan application process flow

Business rules are developed with the rule authoring tools in JBoss BPM Suite to enforce policies and make decisions. Rules are linked with the process models to enforce the correct policies at each process step.

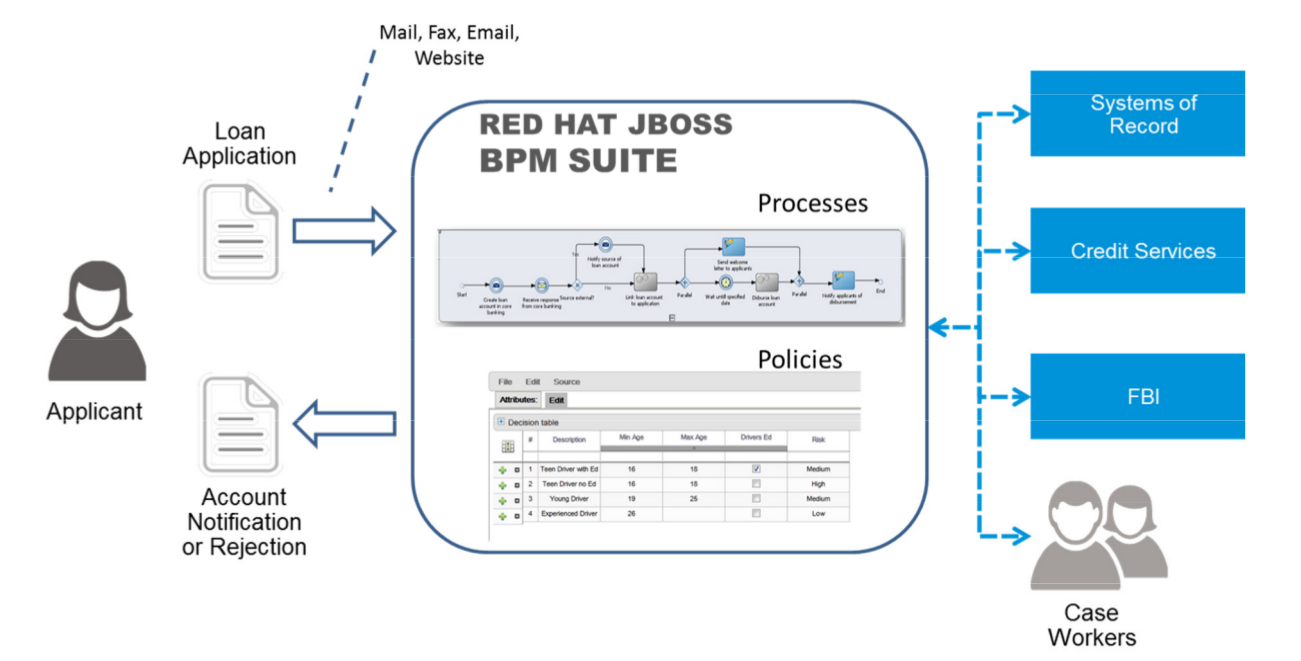

The bank's IT organization deploys the JBoss BPM Suite so that the entire loan application process can be automated.

Figure 1.2. Loan Application Process Automation

The entire loan process and rules can be modified at any time by the bank's business analysts. The bank is able to maintain constant compliance with changing regulations, and is able to quickly introduce new loan products and improve loan policies in order to compete effectively and drive profitability.